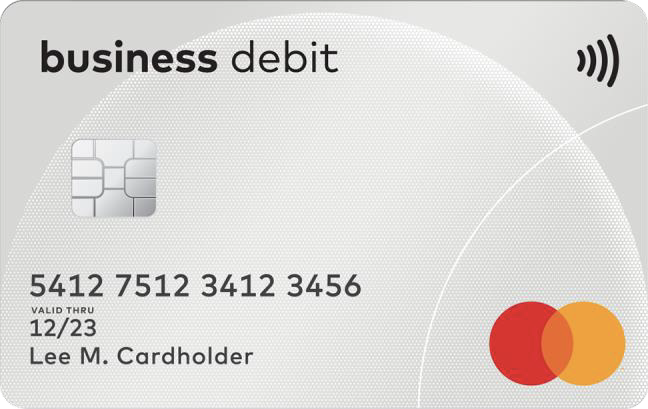

Mastercard Rolls Out Commercial Debit Cards to Support Hong Kong SMBs

November 11, 2021 | Hong KongWhat businesses need to know about the new addition to Mastercard’s wide range of products and services

People around the world have been using credit cards for decades, but Hong Kong has seen a rising trend of debit cards being used for convenient payment in recent years. As they gain more prominence, there are opportunities for businesses in the city to also adopt this new, secure and convenient way to make transactions, in parallel with the trend of digitalization and the development of smart cities globally.

The uptake of commercial debit cards as a payment option coincides with the ongoing economic recovery worldwide, especially among small and medium-sized businesses (SMBs), which have relied on e-commerce in recent years. According to the latest report by Mastercard titled Recovery Insights: Small Business Reset, total sales at SMBs rose 4.5 percent through August 2021 year-to-date compared to the same period in 2020, while e-commerce sales are up 31.4 percent worldwide. Locally, Hong Kong SMBs have outperformed large businesses in food and beverage this year, in contrast to other markets in Asia Pacific.

The pandemic has intensified the need for convenient and contactless payment methods, offering safety and security in both physical and online transactions. With the wide range of payment and purchasing options now available, here is what businesses need to know about using commercial debit cards:

1. What are the benefits and features of commercial debit cards?

Commercial debit cards offer more flexibility, as funds for purchases made with debit cards are deducted directly from account balances rather than on credit. Mastercard commercial debit cards are accepted worldwide via POS and online, and some support multi-currencies with no exchange rate fees for overseas purchases or foreign currency transactions. No annual interest fees are charged when using commercial debit cards, and cardholders can withdraw money via ATMs locally and globally.

Business owners can control the cards’ features, allowing them to easily manage their finances via the banks’ mobile apps, including:

- Temporary blocking and unblocking

- Daily and monthly spending limit control

- Contactless payment, digital wallet, Card-Not-Present transaction limit control

- Overseas ATM withdrawal limit control

- Merchant category blocking, such as for casinos and gambling

Companies can also distribute cards to their employees, avoiding reimbursement processes and having to approve every small purchase.

2. What are the differences between debit, credit and ATM cards?

Compared to credit cards, debit card users do not need to undergo a credit line assessment, and business owners do not have to go through credit checks to obtain business debit cards. Using debit cards will also avoid incurring high interest charges due to overdue payments, as users can only spend what they have in their bank account.

Unlike ATM cards, debit cards can also be used for payment via POS machines and for online transactions on top of cash withdrawals. They also come with offers and features that can help cardholders to save more, and enable the tracking of transactions through alerts and detailed statements.

3. Are commercial debit cards safe and secure?

Through its fast, secure and reliable global payments network, Mastercard commercial debit cardholders enjoy the same robust and multi-layered security protection that comes with any Mastercard payment solution. Businesses can also restrict how, when and where the commercial debit cards can be used, helping them keep their expenditure under control whilst also preventing fraud.

“Mastercard is committed to developing Hong Kong as a smart city, and to supporting the city’s SMBs through flexible, safe, secure and convenient payment technology. Mastercard looks forward to seeing its commercial debit cards become a widely used payment method that serves merchants of all sizes, and to working with our partners and issuers in progressing towards a more digitalized society,” said Helena Chen, Managing Director, Hong Kong and Macau, Mastercard.

The development of Mastercard commercial debit cards is just one aspect of the payment technology company’s commitment to help SMBs around the world, as it pledged to bring 50 million small businesses into the digital economy by 2025.

About Mastercard (NYSE: MA), www.mastercard.com

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.