Middle market businesses are a growth engine for the global economy

June 19, 2024As entrepreneurs become successful, they often outgrow their small business roots and become middle market firms. This fast-growing, resilient sector of the global economy, defined by companies with between 50 to 250 employees, is responsible for 21% of commercial spending — $24.2 trillion in B2B spend in 2022.

Sitting between the small business with its need for streamlined tools, and the complexity of a large enterprise, middle market firms have a unique set of needs. To uncover those growing pains, Mastercard conducted in-depth conversations with commercial providers in six global markets – Brazil, Japan, South Africa, UK, Australia, and Germany.

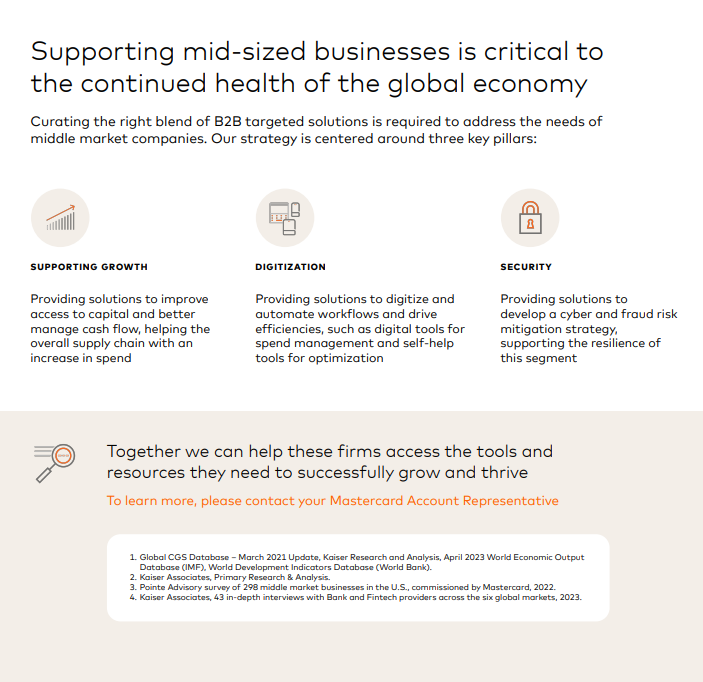

What we found? As middle market firms scale, their ambition to digitize, automate and streamline operations remain largely unfulfilled. This presents a mutually beneficial opportunity for banks, fintechs, and other players to position themselves as the mid-market’s trusted partner — and grow their commercial portfolios.

In this report, we identify the key challenges, needs, and pain points of middle market companies and offer strategic takeaways for banks and fintechs looking to capture a greater share of this critical, yet often overlooked segment. From rising demand for solutions tailored to cash flow management, to the need for better defense against cybercrime, Mastercard sees an untapped opportunity to help the middle market gain the resources they need to achieve their full potential.

White paper

Middle market businesses are a growth engine for the global economy

To understand how we can better meet the needs of middle market businesses globally, Mastercard commissioned research to identify the priorities, pain points and unmet needs of this fast-growing and underserved segment.

Read more