With COVID-19 front of mind, Innovation Challenge puts people first

July 2, 2020 | By Amy KoverIn early March, Abhinava Srivastava found himself sitting at a hospital in Singapore with his father, who had recently been diagnosed with a life-threatening illness — but one that wasn’t COVID-19. It was a scary time moving his dad to Singapore for treatment from India, where the 65-year-old had spent his entire life, just as the coronavirus was unfurling into a global pandemic.

When admitting his father to the hospital, he received an advance bill that made his eyes pop. Because Srivastava’s father was not a Singapore citizen, the hospital expected his dad to pay twice as much as the cost of treatment — and pay it all upfront. The extra charges would cover additional expenses as they arose, and whatever was not used would be reimbursed. He knew that steep bills like this could damage a cardholder’s credit availability as well as hike up their rates if they could not pay the full sum in a month, and as a director of product development for Mastercard that didn’t sit right with him.

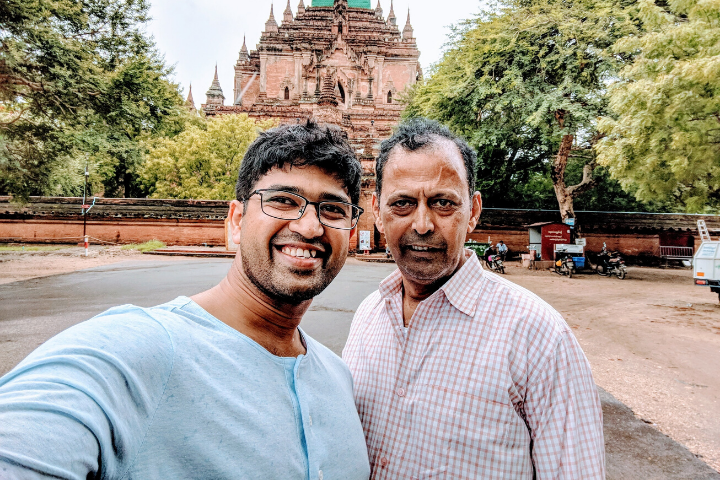

Abhinava Srivastava, left, and his father Abhai Bihari Srivastava.

Then he learned about the COVID-19 Innovation Challenge that Mastercard Labs, the company’s R&D and innovation arm, was launching to enable employees to submit ideas on how to help partners, customers and consumers. With his father’s experience fresh in his mind, Srivastava jumped in.

He and his manager Benjamin Gilbey, senior vice president of Digital Payments and Labs for Asia Pacific, developed a plan to help ease the burden of these lump sum bills by turning the expense into an installment — an old concept undergoing a revival, thanks to new technology and consumers’ growing desire for more choice, control and transparency over how they pay. Now he is working with two different payment teams within Mastercard to get his idea up and running.

Just as other technology heavy hitters, university research centers and governments around the world use virtual hackathons to collect solutions for solving coronavirus-related issues, Paulo Molina, a director on the Innovation Management team, helped create this challenge to tap into the company’s collective wisdom. It’s not just about solving today’s problems: It’s about stepping beyond our always-on innovation initiatives to rethink the types of solutions we offer to our customers and consumers. This can help them navigate the pandemic as well as emerge stronger in the future, post-COVID. Failing to redefine oneself in a rapidly changing world is the fastest route to irrelevance.

Nearly 2,000 employees joined the Microsoft Teams challenge site to collaborate and contribute their ideas, allowing the Labs team and top-level executives to contact submitters directly. In these enterprisewide conversations across multiple time zones, members of the evaluation board could collect submissions in real time and follow up to learn more. “I’ve seen executives go in and engage with the submitters and ask questions that take submissions to a detailed level,” Molina says.

To further support employee thinking around the challenge, the Labs team quickly developed webinars to share insights about the focus areas — including access to capital, tools for disadvantaged communities and aiding small businesses — and to help hone ideas. Meanwhile, employees reached out across business units and regions to test new concepts and press existing solutions into service in new ways.

Of the more than 200 submissions, 30 ideas are under serious consideration with the product teams, two are on their way to be implemented, and one is already is live: The Advisors product team within the Data & Services business quickly harnessed Mastercard’s anonymized and aggregated transaction data to create a new online search tool for consumers that confirms which shops and businesses are open in the last 24 to 48 hours.

“We had the capabilities,” says AnShul Pandey, director, Location Insights, “but we needed to act fast and deliver the information much faster.” It’s a perfect example of assessing what already exists in Mastercard’s toolbox and reimagining how it can make them even more relevant. The tool, now called ShopOpenings.com and live in Italy, the United Kingdom, United States and Canada, not only delivers visibility to small businesses at a critical time, but helps governments, manufacturers and banks understand the state of businesses and inform economic recovery efforts.

In all, Molina was wowed by the tenor of ideas generated in quarantine. “People approached this challenge with a lot of empathy and urgency,” he says, “and that’s a signal that difficult times can often surface — and even propel — ideas that are intrinsically relevant and impactful.”