What is open banking? Your essential guide

November 23, 2022 | By Hayden Harrison

Open banking is helping fuel a revolution in financial services.

It can provide people with more convenient ways to view and manage their money and simpler ways to access credit or personalized deals and rewards. Open banking can also power different kinds of payment services, such as payments in video games or using business accounting apps.

The practice is already helping to widen access to financial services for millions of people and build on the broader introduction of real-time payments and other emerging payment technologies. Open banking is poised to transform financial services, with the potential to disrupt traditional financial services providers as more specialized and targeted services come online.

It puts consumers and small businesses at the center of where and how their financial data is used, ensuring they control it and that they benefit from it through more choice in the way they pay, manage their money, access credit and more.

But while many of us are already using open banking services, few actually know about this trend or what’s going on behind the scenes. So, what exactly is it?

What is open banking?

Simply put, open banking gives you the ability to share your financial accounts’ data to access innovative financial service experiences. Traditionally, only you and your bank could access your financial data. Open banking allows you to share that data with another financial service provider — either a different financial institution or third party, to empower you to use your own data for your own benefit. These third-party providers can include a wide range of fintechs, currency exchanges, merchants and other digital platforms.

1. allowing access or passage to, or a view through; not closed or blocked

Sharing your bank account data with another provider unlocks new or improved financial services — most often via apps — including those that make it easier to access credit and manage your money in one seamless interaction. It’s a little like the privacy permissions on your phone that allow an app to use your camera or location data, but significantly more robust.

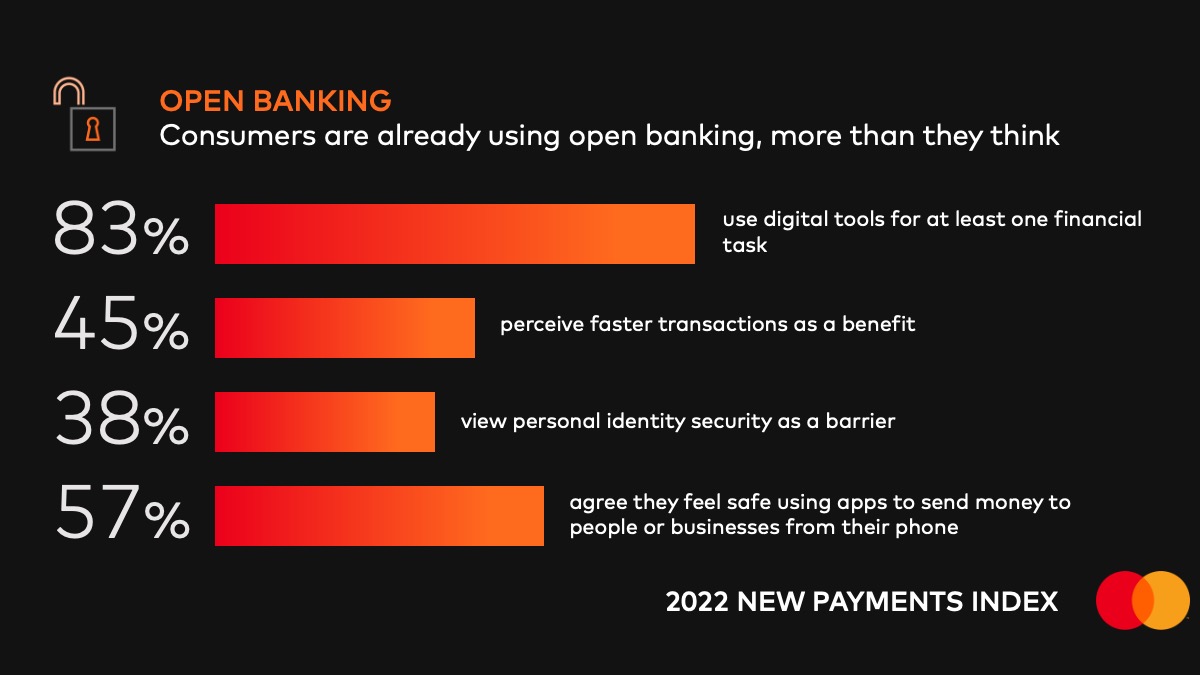

You may already be using open-banking software, since it’s the mechanism that powers many popular financial apps, including Robinhood, the stock-trading app, and Rocket Mortgage, a mortgage-brokering app. Mastercard's 2022 New Payments Index, a global consumer survey of 35,040 respondents in 40 countries, reveals that more people are using open banking than they realize: Only about half know about open banking, but about two-thirds are actually using it to pay their bills, do their banking and make buy now, pay later payments.

What kinds of open banking services are there?

Think about the last time you applied for a loan: all the paperwork involved in proving your eligibility for credit and all the documents you had to gather from various sources. Now, imagine if you could provide that information — your recent financial history — at the click of a button. You can with open banking. It eliminates the need for borrowers or lenders to manually compile, send and verify bank statements and pay stubs and can result in faster, more streamlined applications and lending decisions.

Sharing access to your bank account information can also allow you to access new, tailored and more relevant financial services that improve your control over your data. For example, many of us hold accounts at different banks or brokerages. Open banking allows you to aggregate the information for all those accounts into one real-time dashboard of your choosing, so you can see all your money in one place. It may even make your money smarter: Some financial service providers, such as Aion, overlay artificial intelligence to provide actionable insights to help you create a budget and manage your money.

In some markets, such as the U.K., European Union, India and the U.S., open banking includes mechanisms for people to allow third parties to make payments from your bank account. This can help to maximize rewards, savings and investments, or to help avoid overdraft fees by allowing a financial service provider to move money automatically between your accounts. Open banking payments also can provide a faster and more secure way to make payments online: Instead of having to open your banking app or use another online payment interface, you can make transfers through the service you’re using.

The same or similar services are available for businesses, too. New tools integrate with back-office systems to allow companies to manage their payments and collections, make real-time bank transfers, and achieve greater visibility over their finances.

Can open banking grow financial inclusion?

In certain cases, open banking is bringing digital financial tools to more people, providing small loans and credit for people and businesses who previously couldn’t access these services.

Look no further than people with thin or no credit histories – such as retirees without debt or new immigrants – face a higher risk of being rejected for new loans. That’s because lenders usually require credit reports with up-to-date information. Open banking can resolve that problem by allowing people to prove they’re creditworthy in different ways — for example, by giving lenders access to payroll data or your history of regular rent payments or your overall cashflow.

How does open banking work around the world?

Open banking has existed in some form or another for quite some time. But it’s only now making headlines as the kind of services it enables — from account aggregation to payment services — are being embraced by consumers and businesses.

In some parts of the world, such as the U.S., open banking is industry-led. Innovative fintechs have sought to access people’s data as a means to provide them with improved and tailored financial services, while banks — themselves recognizing the commercial opportunity — have taken the initiative to develop services to let their customers share their data.

Elsewhere, open banking is often regulation-driven, largely with the aim of stimulating competition and innovation. The best-known example of this is in Europe. There, the EU revised the Payment Services Directive (PSD2), which mandated that all banks starting in 2019 allow their customers to securely share their account information with other financial service providers. Mastercard's Open Banking Tracker for Q3 2022 shows 559 third-party providers have registered to provide account information or payment initiation services with national regulators in Europe.

In Australia, regulation goes further — savings accounts, investment accounts and pension accounts are all in scope, with plans to include utility, telecom, and travel data connections in the future. This means a financial services provider can offer a person a more holistic view of their finances and a wider range of financial products.

Switzerland is fostering fintech innovation based on open banking principles, while the Bank of Mauritius has published guidance for providers of open banking payments and information services. Meanwhile, the central bank in Nigeria introduced a legal framework to regulate its previously industry-led effort.

Is open banking safe?

Yes. You control access to your financial data and aspects of data you want to share, along with, of course, who you want to share your data with. If you change your mind having given a provider permission to access your data, you can revoke your consent at any time.

Trusted financial data aggregation platforms facilitate secure access to your data via traditional connections (enriched with bank-grade security) and APIs. Short for application programming interface, APIs make it possible for the software at one company to “plug in to” and access information from the software at another company in real-time.

To further improve your security, the industry is moving toward more “tokenized” access, also known as “Open Authorization” or “oAuth” connections. oAuth connections involve providing a third party with a “token” — a coded alternative to your bank account credentials that has no meaningful value if breached.

In regulated markets there are many procedures in place to protect you and your data against potential fraud and loss.

In Europe, for example, third-party providers have to be registered with a national regulatory agency to provide services under open banking. Only registered providers can access your bank account information with your explicit consent, and you can withdraw that consent at any time. Providers also need to prove they meet security and fraud prevention procedures and meet minimum service level agreements so your data is protected.

The introduction of common standards is helping define how peoples’ data is created, shared and accessed. These standards are issued by national bodies and regulators, such as in the U.S. through the Financial Data Exchange (FDX), a broad cross-section of banks, fintechs, and financial services groups that have aligned around a single data-sharing standard that could accelerate the adoption of open-banking API frameworks — perhaps globally.

Meanwhile, Mastercard, which facilitates this fast, simple and secure data exchange through its Open Banking Solutions and acquired Finicity and Aiia to expand its work in the U.S. and Europe respectively, is collaborating with key industry stakeholders to define and develop the rules and processes to resolve inquiries and disputes in open banking across the global ecosystem.

This story was originally published May 5, 2021 and is periodically updated to reflect the latest news in open banking.

report

Open banking and financial inclusion

Learn how open banking can make it easier and more efficient to serve people who are financially marginalized in the new report, "Purposeful and profitable: Financial inclusion via open banking around the world."

Download the report