Mastercard Champions Women Business Owners Throughout National Small Business Week and Beyond

May 2, 2019 | By Sarah ElyCompany Kicks off New Campaign Spotlighting Women Business Owners Across the Nation and Furthers Efforts to Close the Funding Gap

Mastercard is helping share the stories of the women across the U.S. who are contributing over $3 trillion to today’s economy and opening over eighteen hundred businesses every single day. Today the company announced the launch of a national advertising campaign that puts the spotlight on women business owners who are driving impact. Mastercard is also furthering its commitment to enabling equal funding opportunities for underserved communities including women small business owners and would-be entrepreneurs.

Her Ideas Start Something Priceless

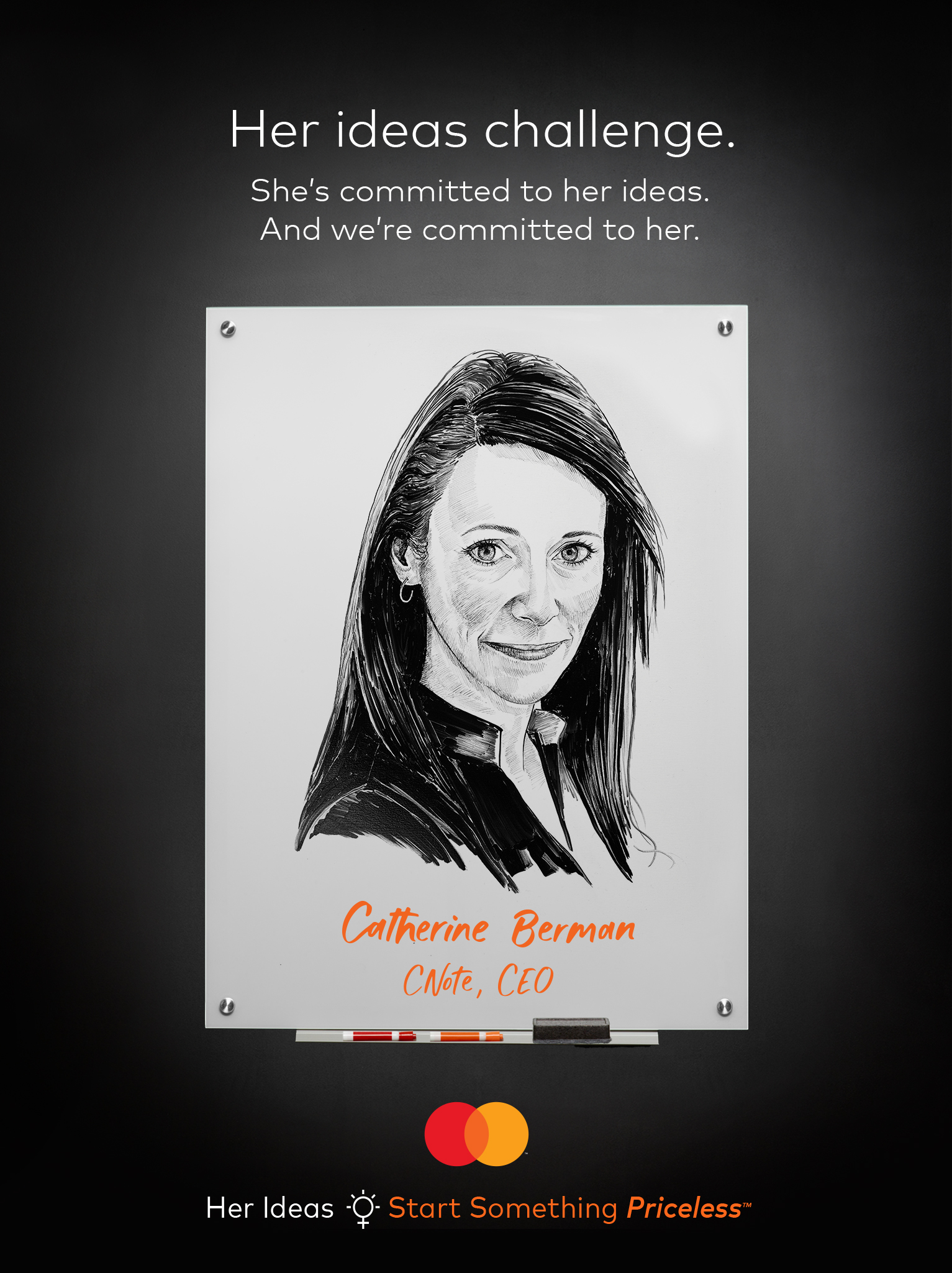

As National Small Business Week approaches and our attention focuses on a segment that is a key driver of the economy, Mastercard is working to ensure that we keep these owners in the spotlight every day - not for just a week. The second phase of the company’s integrated marketing and communications program which kicked off earlier this year features the portraits and stories of women business owners shared in highly visible print, out of home and digital venues. Portraits have long been leveraged to tell the stories of those who help shape our country's culture through remarkable achievements and these women are the epitome of this sentiment.

From a feature in The New York Times to billboards in Times Square and beyond, the company wants to ensure that they’re giving visibility to the women who took an idea and turned it in to impact. The first output of this effort features Deepica Mutyala founder and CEO of Live Tinted, Catherine Berman co-founder and CEO of CNote, Sonja Rasula founder and CEO of Unique Markets and Morgan Debaun CEO and Founder of Blavity among others.

“When you support women entrepreneurs, you’re not only supporting the economy, you are supporting their desire to solve real needs and make a difference in people’s lives. Women are starting businesses with the intention of driving change within their communities, society and the world. By putting a spotlight on them we hope that other women are inspired to pursue their passion,” said Cheryl Guerin, EVP of North America Marketing & Communications at Mastercard.

Women Supporting Women

Forty eight percent of women believe mentorship programs for women is most helpful for the advancement of women entrepreneurs. Mastercard will first introduce this effort through its ongoing partnership with Create & Cultivate by bringing together women business owners and aspiring entrepreneurs for a one-day conference in New York City to inspire, enlighten and inform women around the critical topics for starting and running a business.

"Create & Cultivate New York is one of the biggest events of the year for us and we’re incredibly excited to continue our partnership with Mastercard and highlight female-led businesses." said Jaclyn Johnson, CEO and Founder of Create & Cultivate.

The on-site Mastercard small business marketplace will feature the portraits of local New York founders including East Olivia founder & creative director Kelsea Gaynor, Bliss Lau owner of Bliss Lau, Yes I am Clothing founder Michelle Cadore, Coco and Breezy Eyewear designers and founders, Corianna and Brianna Dotson, and Teressa Foglia founder of Teressa Foglia Hats. The event will also feature a content studio where attendees can have their portrait done and share their idea that sparked their career inspiration.

Equal Opportunity for Underserved Communities

Nearly 27 percent of U.S. households are unbanked or underbanked meaning they can’t access mainstream financial services. For women struggling to support their families, with no credit history or collateral, pursuing a small business idea is a distant dream. Women receive only 4 percent of all small business loans, which is why the Mastercard Center for Inclusive Growth is invested in supporting the development and growth of Community Development Financial Institutions (CDFIs).

CDFIs provide microloans to women who would otherwise be left behind. Mastercard is funding the digitization of three organizations – Grameen America, Opportunity Fund and International Rescue Committee’s Center for Economic Opportunity, to help them move away from a paper and cash business and create digital systems for loan disbursements. This enables an organization to safely scale in the number of women they can support and new places they can reach across the country. In fact, Grameen America has nearly doubled the number of women they serve to more than 116,000 since 2016 as a result of digitizing their organization.

Fueling Female Founded Startups

Mastercard Start Path in partnership with Astia, a trusted global ecosystem of investors and advisors, is working to identify female founded start-ups who are shaping the future of commerce. The award-winning startup engagement program identifies early stage companies that offer promising technologies and show a readiness for scale. Mastercard Start Path and Astia have already supported and invested in three female founded start-ups together including:

- CNote is an award-winning investment platform empowering individuals and institutions to earn a competitive return while investing in women, minorities and small businesses.

- Ellevest is a digital-first investment platform built by women, for women. Because when women are better off, we all thrive.

- Goodworld a fintech that gives charities access to an untapped, rapidly expanding fundraising channel, converting new and existing donors right in their social media feeds.

This news comes on the heels of the company’s announcement around bringing seamless digital resources to the on-the-go, always connected small business owner through an enriched card program and partnership with Intuit.

About Mastercard

Mastercard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. Our global payments processing network connects consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. Mastercard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MastercardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.