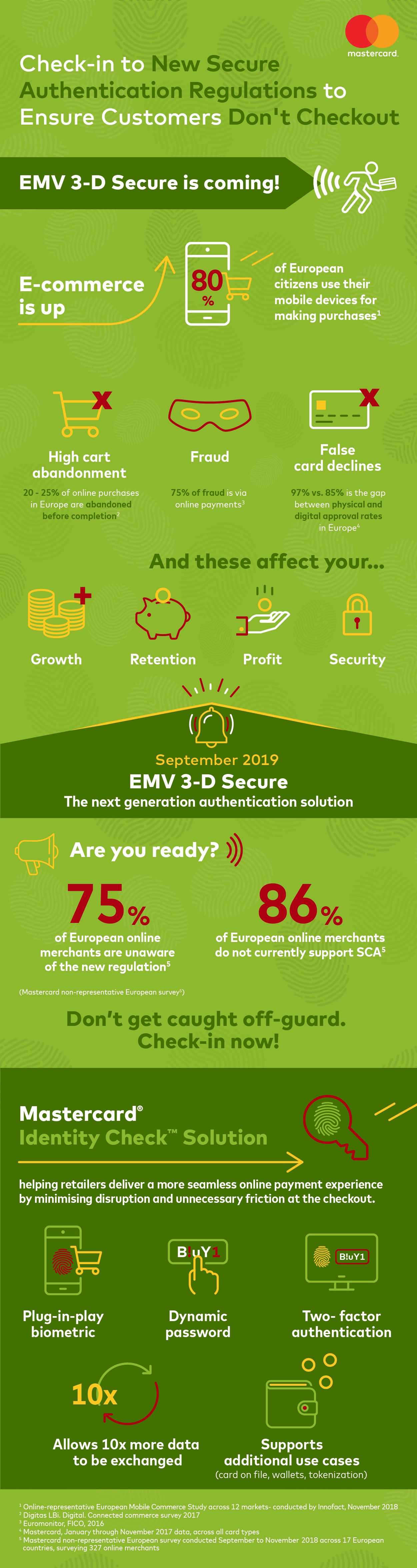

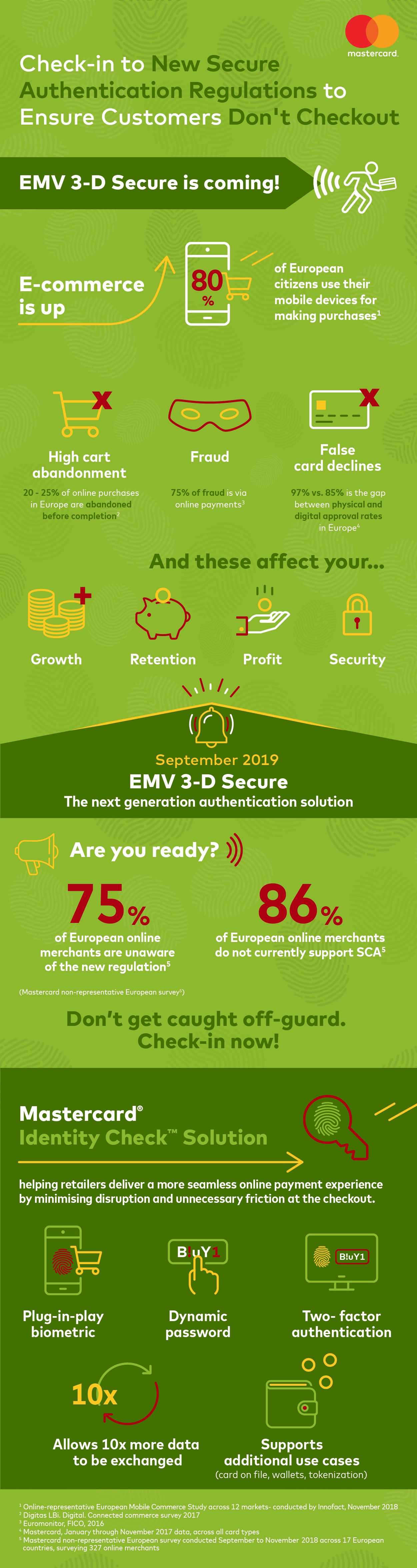

Business and retailers should prepare to deliver strong customer authentication (SCA) to avoid customer dissatisfaction

Waterloo, Belgium - 13 December 2018 – The rise in digital commerce has been a lifeline to many retailers, but Mastercard research targeting a small group of online merchants across Europe revealed that 75% of online merchants in Europe are potentially unaware of a new security standard set to come into effect next year.[i]

Designed to improve the digital payments experience, EMV 3-D Secure (or EMV 3DS) will usher in a new era of safety for online transactions and will enable SCA with an industry standard supporting new technologies like biometric authentication. Despite these changes, only 14% of this sample group of European online retailers already support SCA, with 51% of them stating they will be ready after September 2019 or have zero plans to support it.

SCA will be mandatory under the Payment Service Directive 2 (PSD2) as of September 2019. However, before it does, online retailers need to be prepared. Below are two items to tick off your checklist before summer 2019.

In parallel, issuing banks will also enrol their cardholders in Identity Check and offer them improved authentication methods including biometric authentication.

Aiming at delivering a smoother online payment experience for consumers as this change takes effect, Mastercard is rolling-out Mastercard® Identity Check™ - a next generation authentication solution based EMV 3DS which delivers a more seamless online payment experience for consumers. With so many consumers used to one-click checkouts, this new Mastercard solution is designed to minimise disruption and unnecessary friction at the checkout. Identity Check also supports the SCA requirements of the Payment Service Directive 2.

Milan Gauder, Executive Vice President, Services, Mastercard Europe said: “Digital commerce continues to outpace physical purchases and whilst this is hugely positive for online retailers, it also puts pressure on them to ensure digital transactions are safe and seamless. We conducted the first successful EMV 3DS transaction in September. We’re excited to be migrating our Identity Check solution with EMV 3DS, leveraging real-time authentication methods such as dynamic passwords and biometrics (including fingerprint, Iris, face and voice recognition), to drive a securer online experience and one that’s fit for the future of e-commerce.”

With lower approval rates and higher fraud rates, the gap between digital and physical purchases remains an issue. The fraud rate for digital payments is ten times higher than for physical transactions in Europe, leading to negative impact on usage and attrition.

To prepare for the rollout of Mastercard® Identity Check™, Mastercard ran an early adopter phase with results indicating that the new solution led to less fraud, lower card declines, and hassle-free authentication for the consumer. Not only did this result in an enhanced user experience, but it helped drive up profits for retailers and issuers.

“With digital commerce becoming the norm, and new regulatory requirements coming on board, innovative solutions are required to ensure retailers are continuing to delight customers online. With the power to exchange 10 times more data between merchants and issuers compared to the current authentication messages, including new mobile capabilities, we are determined to raise the bar on authentication,” added Milan Gauder.

About Mastercard

Mastercard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. Mastercard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MastercardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Contact

Philipp Bruchert

philipp.bruechert@mastercard.com; +32 2 352 52 58

[i] Mastercard non-representative European survey conducted September to November 2018 across 17 European countries, surveying 327 online merchants.

Waterloo, Belgium - 13 December 2018 – The rise in digital commerce has been a lifeline to many retailers, but Mastercard research targeting a small group of online merchants across Europe revealed that 75% of online merchants in Europe are potentially unaware of a new security standard set to come into effect next year.[i]

Designed to improve the digital payments experience, EMV 3-D Secure (or EMV 3DS) will usher in a new era of safety for online transactions and will enable SCA with an industry standard supporting new technologies like biometric authentication. Despite these changes, only 14% of this sample group of European online retailers already support SCA, with 51% of them stating they will be ready after September 2019 or have zero plans to support it.

SCA will be mandatory under the Payment Service Directive 2 (PSD2) as of September 2019. However, before it does, online retailers need to be prepared. Below are two items to tick off your checklist before summer 2019.

- Contact your acquirer or payment service provider to ensure your business is ready and enrolled in Identity Check.

- Educate your consumers. Let them know you will be making changes to their payment experience highlighting the benefits for them (no need to remember passwords and a likely reduction in fraud).

In parallel, issuing banks will also enrol their cardholders in Identity Check and offer them improved authentication methods including biometric authentication.

Aiming at delivering a smoother online payment experience for consumers as this change takes effect, Mastercard is rolling-out Mastercard® Identity Check™ - a next generation authentication solution based EMV 3DS which delivers a more seamless online payment experience for consumers. With so many consumers used to one-click checkouts, this new Mastercard solution is designed to minimise disruption and unnecessary friction at the checkout. Identity Check also supports the SCA requirements of the Payment Service Directive 2.

Milan Gauder, Executive Vice President, Services, Mastercard Europe said: “Digital commerce continues to outpace physical purchases and whilst this is hugely positive for online retailers, it also puts pressure on them to ensure digital transactions are safe and seamless. We conducted the first successful EMV 3DS transaction in September. We’re excited to be migrating our Identity Check solution with EMV 3DS, leveraging real-time authentication methods such as dynamic passwords and biometrics (including fingerprint, Iris, face and voice recognition), to drive a securer online experience and one that’s fit for the future of e-commerce.”

With lower approval rates and higher fraud rates, the gap between digital and physical purchases remains an issue. The fraud rate for digital payments is ten times higher than for physical transactions in Europe, leading to negative impact on usage and attrition.

To prepare for the rollout of Mastercard® Identity Check™, Mastercard ran an early adopter phase with results indicating that the new solution led to less fraud, lower card declines, and hassle-free authentication for the consumer. Not only did this result in an enhanced user experience, but it helped drive up profits for retailers and issuers.

“With digital commerce becoming the norm, and new regulatory requirements coming on board, innovative solutions are required to ensure retailers are continuing to delight customers online. With the power to exchange 10 times more data between merchants and issuers compared to the current authentication messages, including new mobile capabilities, we are determined to raise the bar on authentication,” added Milan Gauder.

About Mastercard

Mastercard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. Mastercard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MastercardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Contact

Philipp Bruchert

philipp.bruechert@mastercard.com; +32 2 352 52 58

[i] Mastercard non-representative European survey conducted September to November 2018 across 17 European countries, surveying 327 online merchants.